Read all about my experiences climbing to Everest Base Camp with Ant Middleton. The lessons learned & how it transformed my perspective on life.

Learn about the top 10 signs your business needs a professional business advisor. From cash flow issues to on clear strategy – make the change today!

Struggling with growth, finances, or efficiency? Discover the key moments when hiring a business consultant can transform your company’s success.

Learn how AI in small businesses drives growth and efficiency. Read our blog to explore its uses and thrive in today’s fast-paced world!

Where to Invest in the UK: Top 10 Business Opportunities for the Next Decade

Explore the top 10 UK business opportunities from investors, in sectors like green energy, fintech, AI and more.

Top 9 Investment Opportunities in Dubai Right Now

Discover the top investment opportunities in Dubai for 2025, including real estate, technology, healthcare and more.

Is Online Business Coaching as Effective as In-Person?

Discover whether online business coaching matches the impact of in-person sessions, with insights on benefits, myths, and key differences.

How to Choose a Marketing Consultant for Your Small Business

Learn tips for selecting a marketing consultant that aligns with your small business goals, and how to evaluate key factors to ensure growth.

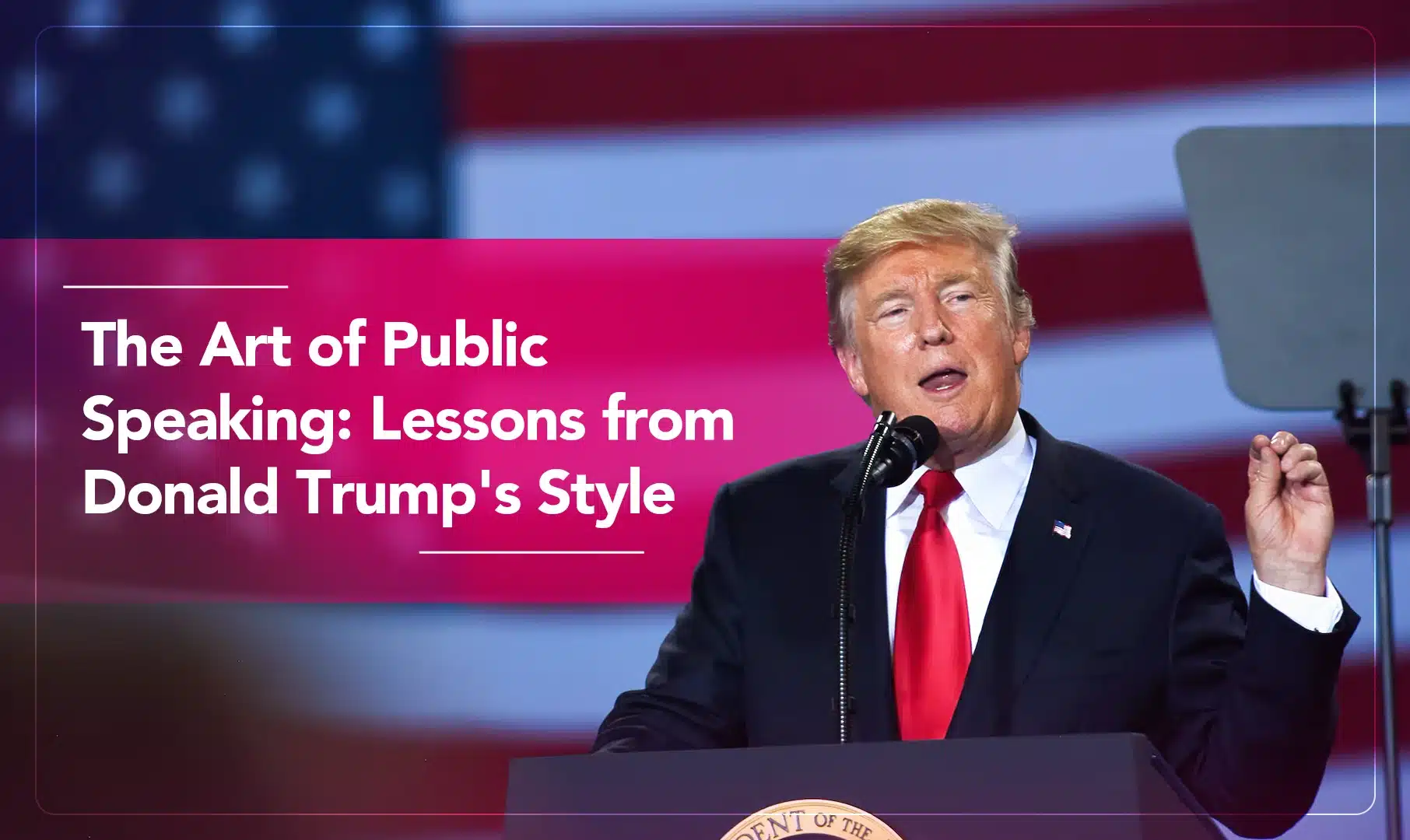

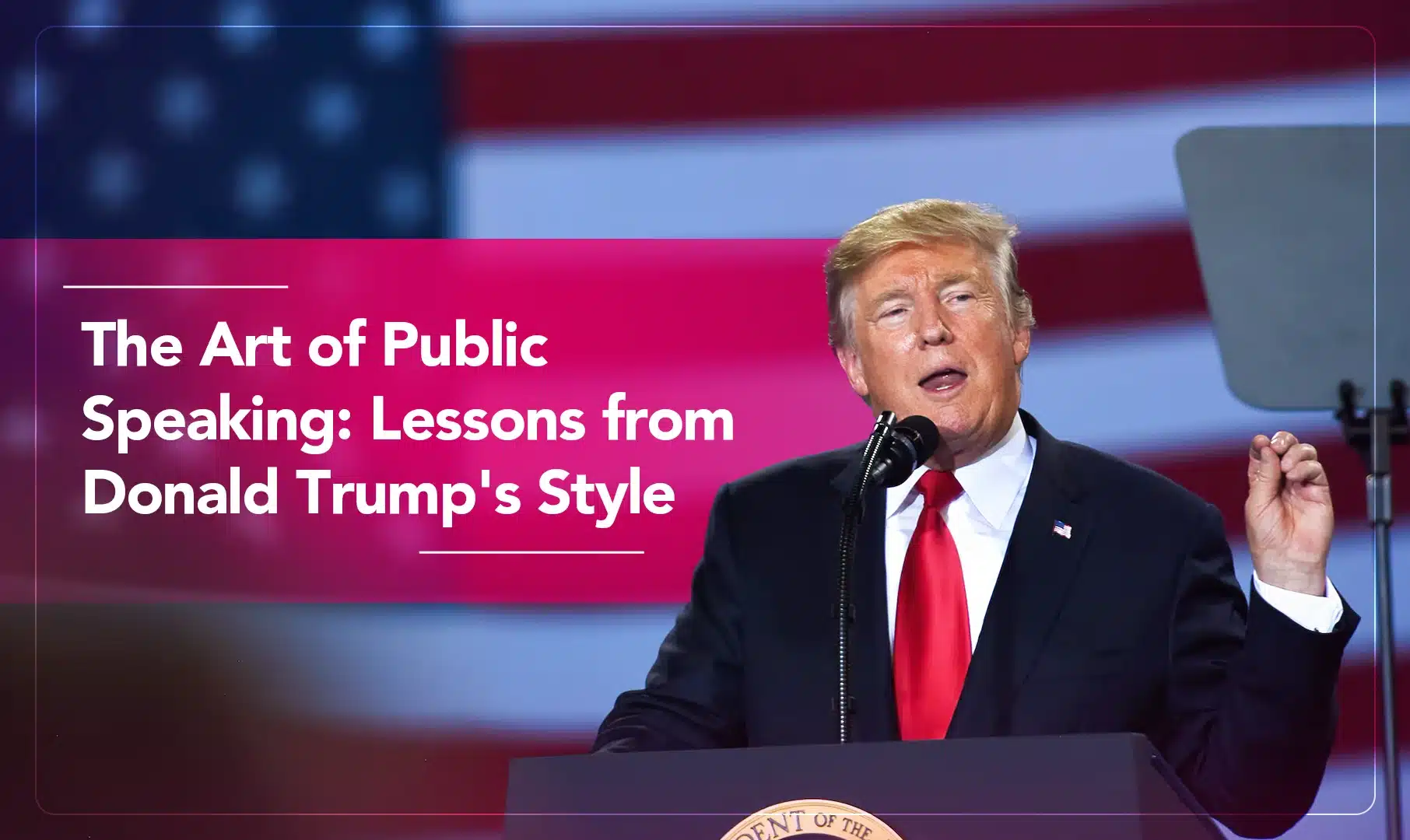

Donald Trump’s Speaking Style – Love It or Hate It, It Works

Explore the effectiveness of Donald Trump’s speaking style & discover key techniques that entrepreneurs can use to enhance their communication impact.

Top 10 Best Business Speakers for Events (UK 2025 Edition)

Discover the top business speakers for events in the UK for 2025. Learn how to select speakers who deliver actionable insights & inspire change.

7 Best Types of Business Loans for Startups in the UK

Discover the best business Loans for startups to fuel growth, manage cash

Elon Musk’s Top 13 Inventions That Changed the World

Elon Musk, often compared to a real-life Tony Stark, has built a

How Quick Small Business Loans Fuel Long-Term Growth (4 Key Strategies)

Learn how quick small business loans can boost cash flow, fund expansion

11 Most Controversial Billionaire Quotes on Money & Wealth

Discover bold and unconventional billionaire quotes on money, success, and wealth-building that

How Much Is Donald Trump Worth? (2025 Update)

As President of the United States, Donald Trump’s net worth in 2025 is frequently a hot topic. According to Forbes, Bloomberg, and Business Insider, his

11 Most Controversial Billionaire Quotes on Money & Wealth

Discover bold and unconventional billionaire quotes on money, success, and wealth-building that challenge traditional financial habits and beliefs.

Quick Business Loan Repayment: Best Practices for Entrepreneurs

Taking out a business loan can give your company the financial boost

Exploring Alternative Financing Options When Traditional Business Loans Aren’t an Option

Securing traditional business loans can be challenging, especially when you are doing

The Influence of Global Economic Trends on UK Business Investment Strategies

In today’s globalised world, businesses in the UK are navigating an increasingly

How Business Consultants Guide Start-Ups Toward Financial Stability

Starting a business is exciting, but keeping it afloat can be challenging.

Where to Invest in the UK: Top 10 Business Opportunities for the Next Decade

Explore the top 10 UK business opportunities from investors, in sectors like green energy, fintech, AI and more.

Donald Trump’s Social Media Strategy – Lessons for Business Growth

Discover how Donald Trump’s social media tactics can inspire your business growth by building a robust personal brand and creating emotion-driven content.

Forging Business Warriors: Insights from Gladiator Summit Founder Dariush Soudi

Dariush is an experienced entrepreneur and life coach who has faced personal

Breaking Free: Natalie Russell on Empowering Women to Reclaim Their Lives and Relationships

Natalie Russell is a dedicated self-esteem and relationship recovery coach, creator of

The Power of Personal Branding: From Basics to Advanced Strategies, with Kelly Lundberg

Kelly Lundberg is a highly successful entrepreneur, personal brand strategist, and speaker.

From Football Dreams to Resilient Realities: Yannick Rebsamen’s Inspiring Journey of Overcoming Adversity and Rebuilding Life After Tragedy

Yannick is an inspiring entrepreneur whose life took a dramatic turn in

Donald Trump’s Speaking Style – Love It or Hate It, It Works

Explore the effectiveness of Donald Trump’s speaking style & discover key techniques that entrepreneurs can use to enhance their communication impact.

Top 10 Best Business Speakers for Events (UK 2025 Edition)

Discover the top business speakers for events in the UK for 2025. Learn how to select speakers who deliver actionable insights & inspire change.

Beyond Base Camp: Lessons I Learnt From Everest

Read all about my experiences climbing to Everest Base Camp with Ant

Measuring ROI of Motivational Business Speakers (2025 Guide)

Learn how to measure the ROI of hiring a business motivational speaker,

Unlock Success: Business Speakers For Corporate Events

Learn why business speakers for Corporate events are a must! Learn the

Business Coach for Entrepreneurs: Making Smarter Financial Decisions

Discover how a business coach for entrepreneurs can help you make smarter

This One Strategy Raised Me Over £100 Million From Investors!

I’m writing this as I prepare to head over to my yacht, the tastefully named Seasquirter ?, to host one of my regular Thursday night

This week’s podcast! Matt Haycox chats to influencer boss Emilio Arciniega

In this episode, I explore Emilio’s journey into the marketing and talent industry, during which he turned a £40 commission into a full-time career. Learn

This week’s podcast! Matt Haycox chats to ex ‘SAS: Who Dares Wins’ Ant Middleton

Meet Ant Middleton—the real deal, a living, breathing symbol of resilience and

Change Your Environment, Change Your Life: Why Your Surroundings Matter

If you want to change your life, then change your environment!

This week’s podcast! Matt Haycox chats mental health with Dr. Frankie Jackson-Spence

This week, I’ve got a special episode for you, tying in with World

Happy World Smile Day!

Don’t worry, I am not jumping on a woke bandwagon and becoming

Subscribe To The No Bollocks Newsletter

Matt's Podcasts

STRIPPING OFF WITH MATT HAYCOX

Welcome to 'Stripping Off with Matt Haycox,' where we bare it all on business, money, and life. Get ready to peel back the layers of success with the Funding Guru himself, Matt Haycox.

NO BOLLOCKS WITH MATT HAYCOX

Welcome to "No Bollocks with Matt Haycox," the ultimate business podcast for entrepreneurs, CEOs, and anyone looking to climb the career ladder without the bullshit.