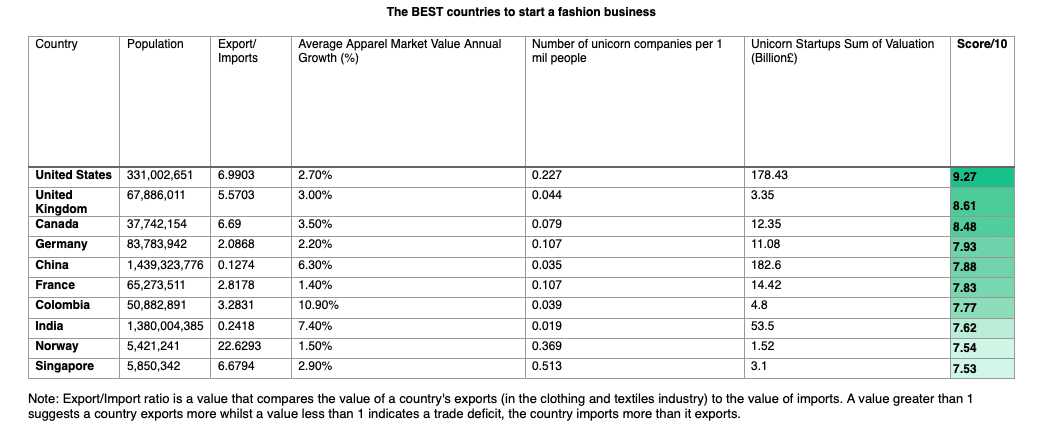

The US is the best country to start a fashion business, with the valuation of unicorn start-ups in the consumer & retail space at £178.43bn, according to a new report.

The new study, commissioned by wholesale platform JOOR, analysed country population, import and export figures, apparel market valuation, and number and valuation of ‘unicorn companies’ in the consumer and retail market.

A unicorn is a privately held start-up company valued at over US $1 billion.

The report scored the US, 9.27 out of 10 on the scale, with a market value annual growth rate of 2.7%. And the UK came in second, with a score of 8.61%.

Although the UK annual growth rate for the apparel market is higher than in the US (3%), the valuation of unicorn start-ups in the consumer & retail space is significantly lower, at just £3.35bn.

The UK also exports more than it imports, having an export/import ratio of 5.57.

Markets Canada, Germany and China were also all in the top 5.

TOUGH COMPETITION

But, despite the US coming up trumps, it’s also one of the hardest markets to crack as a fashion retailer due to tough competition and high operational costs. Established UK retailers, such as M&S, have launched there and failed.

The US market is also challenging, with inflation and an uncertain jobs market dampening consumer spending. This is combined with political uncertainty, ahead of the 2024 US presidential election, which is adding to volatility in the market from an investment and business perspective.

Many Direct-to-Consumer (D2C) fashion businesses are looking to wholesale partnerships to crack not only the US market, but for global expansion in general, as the cost for customer acquisition (which falls to the retailer) can take significant pressure off their P&L sheet.

NIKE’S U-TURN IN STRATEGY

And the world’s biggest brands are not immune from making mistakes in strategy.

After aggressively shutting down many of its wholesale accounts over the course of the last few years, to focus on a tighter D2C strategy where it sells direct to its consumers and in turn owns all the customer data, sportswear giant Nike has made a U-turn.

In June, it said it plans to re-establish relationships with the likes of US department store chain Macy’s, which has 504 stores across the US. As well as Designer Shoe Warehouse, which has over 500 stores in the US and Canada.

As part of its strategic wholesale withdrawal, it pulled out of partnerships with retailers including Urban Outfitters and Zappos. On a company earnings call in March last year, Nike’s chief financial officer, Matt Friend, said the business had cut 50% of its wholesale accounts since 2018.

But, as it turns out, being able to tap into a ready-made audience, which can in turn help raise brand awareness, with fairly decent (albeit not as healthy) margins has its benefits.

And the growth of marketplaces, which give consumers a plethora of choice, have only added to the need for collaboration. Friend admitted: “Wholesale partners play an integral role in our future marketplace, first, to authenticate our brands and then to create scale of distribution through a consistent customer experience across a larger retail footprint.”

SHOULD YOU LAUNCH A FASHION START-UP NOW?

The market is tough for fashion retailers. Inflation, higher borrowing costs and the cost-of-living crisis have all impacted UK fashion businesses. This has been compounded by supply chain issues, a repercussion of the pandemic and the war in Ukraine, which has led to delays in shipments and stock arriving at the wrong time for the wrong season.

The cost for online advertising has also surged, making it much more expensive to acquire new customers online, if you don’t have bricks and mortar stores.

Online fashion giant ASOS has been left with millions of pounds of unsold stock, as it grapples with inventory issues and customers returning items.

The business, which originally launched in 2000 as celebrity-inspired fashion site As Seen On Screen, grew at a time when borrowing was cheap and investors were focused on sales and growth, rather than bottom line profit. To be fair, it’s a strategy that worked for Amazon, which spent years chasing market dominance over profit.

But the market has changed. The collapse of high-profile retail businesses, such as the furniture retailer MADE.com in November, which made over a billion in sales but virtually no profit in a decade of trading, is a key example of this.

Despite a market valuation of £775m when Made.com went public in London in 2021, after a stellar pandemic performance, its value was virtually wiped out only a year later as it struggled to raise fresh equity on a business model that focused on growth and revenue over profits.

And within the fast fashion space itself, the competition for spend is squeezing pockets and consumer spend even further. With upstart Chinese e-commerce giants Shein and Temu, both clipping at the heels of the more established players. Delivering quick turnaround, super cheap clothing based on AI-driven algorithmic trends.

We’ve outlined a few key nuggets from Matt’s experience of running and closing a fashion retailer, which you can take to your own business. Or if you’re considering launching a new fashion start-up in the current market, use as a helpful checklist.

MATT HAYCOX: 7 Lessons Learnt from A Failed Fashion Business

1. Be clear on your USP

The economics of selling a commodity are never good. Everyone’s selling the same stuff and there’s no point of difference.

2. Don’t believe people who say ‘our industry is different’

The principles of business are universal. Don’t ignore your business rules.

3. A business is only a business if it makes money

Number one rule of business. You need to be generating a profit.

4. Branding is everything

The strength of your brand allows you to generate customers, charging higher margins.

5. The only thing that matters is ROI

Awards and campaigns – nothing matters unless you’re seeing a return on investment.

6. Pick a strategy and stick with it

Don’t chop and change your strategy, you need to give something time to bed in. (But don’t be too proud to pivot if the data shows you were wrong).

7. You are only as successful as your ability to market

This rings true for any business. It doesn’t matter how good your product is or how good your staff are. If you can’t get yourself in front of people, cost effectively, you haven’t got a business.

Have a great idea but need the money to get it up and running? Want to start building your investment portfolio? Or have a great start-up but need coaching to take it to the next level? We can help – get in touch to find out more.

STAY UP-TO-DATE

For fresh insights, company news and business advice, subscribe to the weekly Matt Haycox newsletter.