Dubai is one of the world’s most entrepreneur-friendly cities in the world. The opportunities and connections you can make here are huge – it’s part of the reason why I chose to base myself here. But it’s not the only reason; with strategic access to global markets, zero personal income tax and amazing infrastructure, business life in Dubai can absolutely thrive. As a private business coach, I’ve seen so many entrepreneurs turn ideas into success. Whether you’re a solo founder, a global investor or an expat looking to launch something new, Dubai offers business owners so much, it really can be hard to resist.

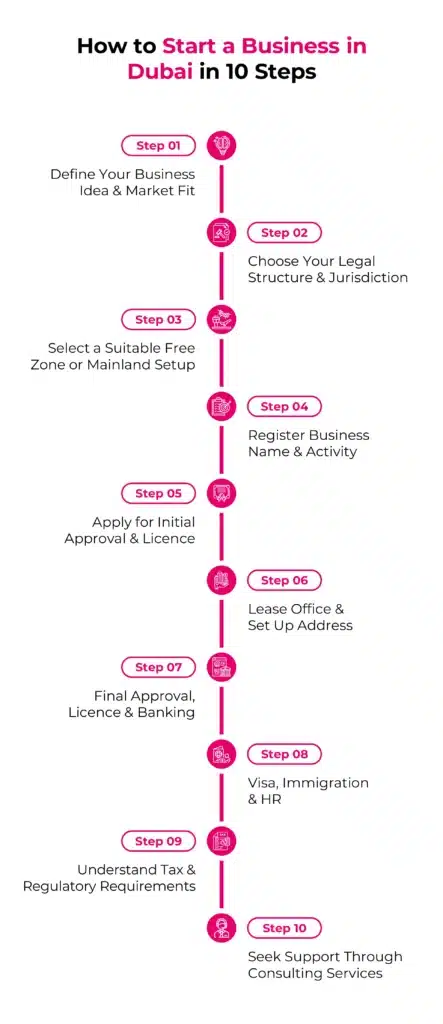

If you’d like to know how to open a business in Dubai, then this guide is for you. Here, I’ll walk you through the ten essential steps to start a business in Dubai in 2025, including legal, administrative and regulatory decisions you’ll need to make sure you get it all right first time.

In this article, I’ll run through:

- How Dubai offers amazing opportunities for entrepreneurs

- Why you need strategic planning and compliance with local markets and regulations

- 10 steps to ensure successful business setup, from defining your idea to obtaining licenses

10 Steps to Starting a Business in Dubai

1. Define Your Business Idea & Market Fit

Every successful business begins with a strong idea. There’s no disputing that. But in Dubai, that idea also has to align with local demand and regulations. While the opportunities here are vast, you have to make sure your idea fits in. Clarify your core offering and determine the category it fits into: eCommerce, consulting, real estate, hospitality, creative services or something else.

Do thorough market research to make sure Dubai is right for you. Use platforms like Invest in Dubai to analyse demand, competition and legal restrictions. You also need to think about cultural preferences and whether your product or service fits with local expectations, as well as which business type is profitable in Dubai.

A business that fits the market and complies with local laws is far more likely to thrive.

2. Choose Your Legal Structure & Jurisdiction

Your legal structure determines ownership rights, tax exposure and who you can trade with. In Dubai, your three main options are:

- Mainland: Set up through the Dubai Department of Economic Development (DED). Ideal for operating across the entire UAE. Most sectors now allow 100% foreign ownership.

- Free Zone: Ideal for specific industries. Offers full foreign ownership, 0% tax benefits and repatriation of profits. However, you’re limited to doing business within that zone or internationally.

- Offshore: Mainly for holding companies or international businesses that don’t require a physical presence in the UAE.

Each structure has its own set of compliance rules. Choose based on your business model, target audience and scale. If this sounds a bit scary and confusing, I offer a business consulting service to help you navigate the complexities and make the right decision for you.

3. Select a Suitable Free Zone or Mainland Setup

If you opt for a free zone, select one that aligns with your sector and operational needs. For example:

- DMCC (Dubai Multi Commodities Centre): Ideal for trading, crypto and financial services.

- JAFZA (Jebel Ali Free Zone): Focuses on logistics, shipping and manufacturing.

- Dubai Internet City: Perfect for tech and media firms.

Mainland companies set up through DED, offering wider trading options across the UAE and fewer restrictions on office locations and activities. Reforms have made it possible to own mainland companies without a local partner in most sectors. Again, if this sounds confusing, speak to an experienced consultant who can walk you through everything you need to know about your business.

4. Register Your Business Name & Activity

Next, reserve a trade name. The UAE has strict naming guidelines:

- Avoid offensive terms, religious references or names of other institutions.

- No abbreviations (e.g. ‘F&B LLC’) unless licensed.

- Include your business structure suffix (e.g., LLC or DMCC).

Make sure you have a few options available in case you can’t register your first choice. That means you need to mentally prepare yourself for disappointment, so try not to fall in love with anything before it’s official. As part of this process, you’ll need to define your business activity, as this determines your licence category.

5. Apply for Initial Approval & Licence

Once your business name is approved, you’ll need to apply for initial government approval. This step is absolutely critical. To do this, you’ll need to put these documents together:

- Passport and visa copies

- Business plan and shareholder agreement

- KYC and background checks

- Articles of Association (AOA)

Certain sectors may require extra approvals, like healthcare, education or food services.

Once approved, you can start fleshing out your business with premises, licencing and banking.

6. Lease Office & Set Up Address

All businesses in Dubai must have a physical address. What this is depends on your legal structure.

Free zone companies can lease flexi-desks, shared offices or private offices within their zone. However, mainland companies must lease from registered commercial spaces and meet DED requirements.

Your lease contract is required for final licence approval, visa allocation and bank account opening. You’ll need to work with your zone authority or real estate consultants to secure a space that is all above board.

7. Final Approval, Licence & Banking

Once you’ve found your office (or other type of business address), you can submit all the final documents and get your business licence. To do this you’ll need your lease contract, notarised MoA (Memorandum of Association) and finalised shareholder structure.

Once that’s approved, you can open a corporate bank account. Popular UAE banks include HSBC, ADCB, Emirates NBD and Citibank. Be prepared for plenty of KYC checks, especially when it comes to international shareholders.

8. Visa, Immigration & HR Setup

After licensing, apply for your investor visa and any employee visas through your free zone authority or the General Directorate of Residency and Foreigners Affairs (GDRFA).

You’ll need medical exams and Emirates ID applications labour cards, and employment contracts if you’re hiring staff.

Some free zones offer visa quotas based on office size. Mainland companies follow the Ministry of Human Resources and Emiratisation (MOHRE) process.

9. Understand Tax & Regulatory Requirements

Since 2023, the UAE has introduced a 9% corporate tax for businesses earning over a certain amount per year, unless they qualify for exemptions (e.g. free zone entities with economic substance).

Key points to know:

- No personal income tax in Dubai

- 0% VAT for exports; 5% for domestic goods/services

- Free zones offer import/export duty exemptions and 100% profit repatriation

If and when your business qualifies, make sure you file annual financial statements, register for VAT (if applicable) and meet local compliance obligations.

10. Seek Support Through Consulting Services

The above steps might seem a little daunting at first – at least when compared to setting up a business in the UK – but it’s actually pretty straightforward. That being said, you do need to make sure you have all the right documents and follow all the processes. If you don’t, it can lead to expensive mistakes. So, if you’re new to the Dubai business world, you should seek professional guidance, like my very own business consulting service.

For more information, read my article on 10 start up mistakes to avoid.

Ready to Launch Your Business in Dubai?

With these steps, you know how to start a business in Dubai without any confusion, delays or hassle. The key takeaways are:

- Choosing the right legal structure and jurisdiction (mainland, free zone or offshore) is crucial for compliance and business operations.

- Getting all necessary approvals, setting up a physical presence and understanding tax regulations are key steps for a smooth setup.

- Consulting services can provide essential guidance for newbies, preventing expensive mistakes and ensuring a hassle-free launch.

Want to start your own Dubai-based business but not sure what to do next? My startup consulting services help founders launch faster by offering personalised guidance on licensing, company formation, visas and more. You can also apply for a startup loan so you can turn your business dreams into a reality. That way, you can follow your passion with full peace of mind.