As a business owner, you know that managing cash flow is essential for the survival and growth of your venture. However, maintaining a healthy cash flow can sometimes be challenging, especially when unexpected expenses arise or when waiting for clients to pay their invoices. In such situations, quick business loans can provide a much-needed lifeline.

Cash flow challenges are a common reality for many small businesses. From covering day-to-day expenses to investing in growth opportunities, having access to adequate cash is crucial. However, fluctuations in revenue, unexpected costs, and delayed payments can create cash flow gaps that need to be addressed swiftly.

Benefits of Quick Business Loans

Quick business loans offer several benefits that make them an attractive option for addressing immediate cash flow needs. Unlike traditional bank loans, quick business loans are designed to provide fast access to funding with minimal paperwork and processing time. This accessibility, combined with flexibility in loan terms, makes them an invaluable solution for businesses in need.

Tips for Effective Cash Flow Management with Quick Business Loans

-

Assessing Cash Flow Needs:

Before applying for a quick business loan, it’s essential to assess your cash flow needs accurately. Determine the amount of funding required and the purpose for which it will be used. Whether you need to cover operational expenses, purchase inventory, or invest in marketing, having a clear understanding of your cash flow requirements will help you choose the right loan amount.

-

Choosing the Right Loan Type:

Quick business loans come in various forms, including lines of credit, short-term loans, and invoice financing. Each type of loan has its own set of terms, rates, and repayment schedules. Take the time to research and compare different loan options to find the one that best suits your needs and financial situation.

-

Comparing Lenders:

Not all lenders are equal. When seeking a quick business loan, it’s crucial to compare lenders to find the best terms and rates. Look for reputable lenders with transparent pricing and favourable repayment terms. Online lenders, alternative financing companies, and credit unions are all potential sources of quick business funding.

-

Understanding Repayment Terms:

Before accepting a loan offer, make sure you understand the repayment terms and associated costs. Consider factors such as interest rates, fees, and repayment schedules. Choose a loan with repayment terms that align with your cash flow projections and business goals.

-

Utilising Funds Wisely:

Once you’ve secured a quick business loan, it’s important to use the funds wisely to improve your cash flow. Prioritise spending on essential expenses that directly contribute to revenue generation or business growth. Avoid unnecessary expenditures and focus on maximising the return on your investment.

-

Monitoring Cash Flow:

Effective cash flow management doesn’t end after securing a loan. It’s essential to monitor your cash flow regularly and make adjustments as needed. Keep track of incoming and outgoing funds, identify potential cash flow gaps, and take proactive steps to address them.

A successful business relies heavily on its ability to manage cash flow. Quick business loans can provide the financial flexibility needed to navigate cash flow challenges and seize growth opportunities. By following these tips for effective cash flow management, you can make the most of your quick business loan and ensure the long-term financial health of your business.

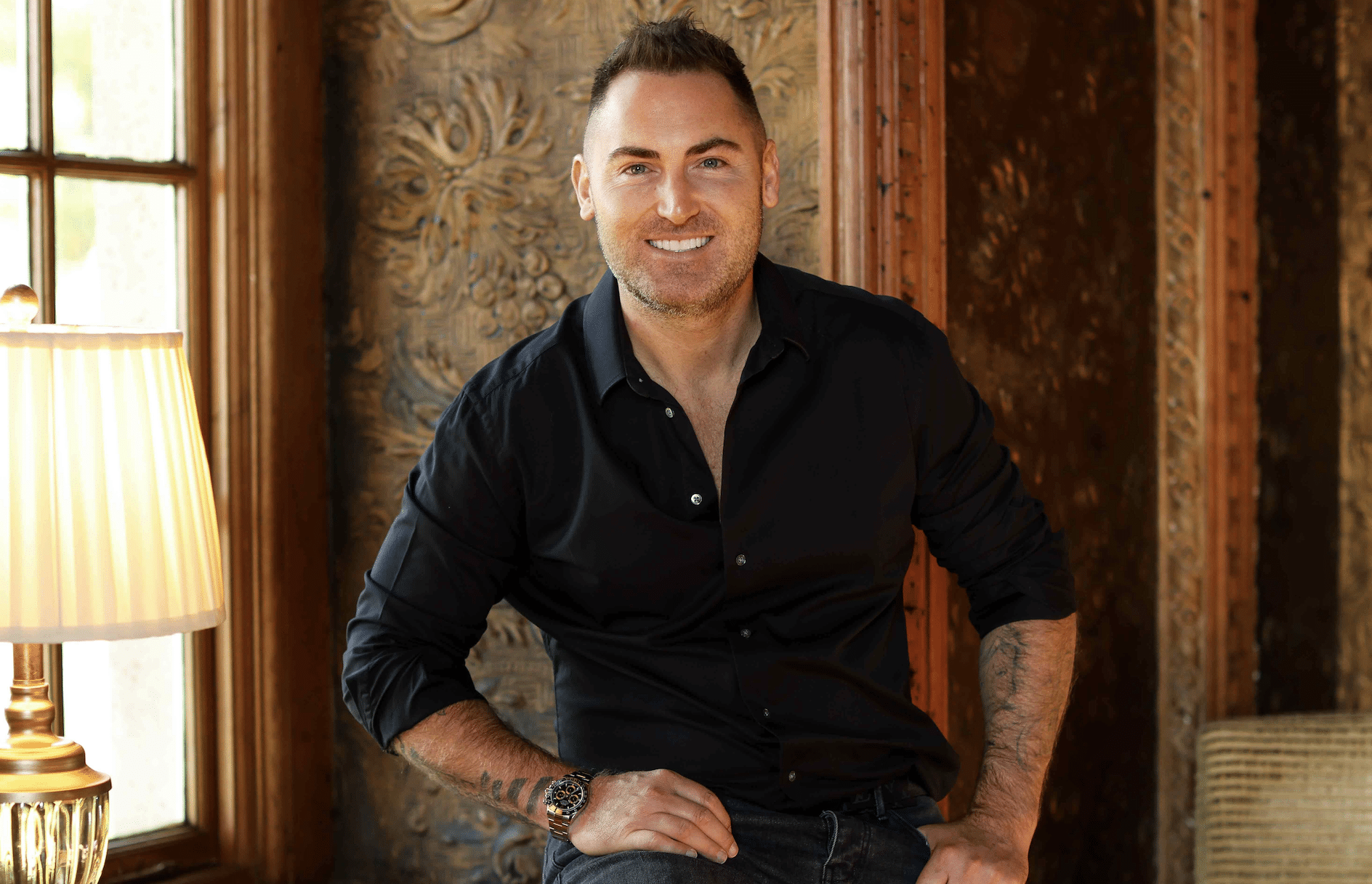

Get in touch with Matt Haycox today! With his expertise and experience in business financing, Matt can help you with the right business loan tailored to your needs.