Scaling a business has become essential for long-term success. Whether you’re a start-up, eager to grow or an established brand looking to expand, the right business funding is crucial. This blog explores the vital role that funding plays in scaling your company.

What Is Scaling in Business?

Scaling a business goes beyond simply growing revenue. It’s about increasing your capacity to handle more customers and larger demands without being restricted by operational inefficiencies. This means optimising resources and systems so you can grow without proportionally increasing your costs. The ultimate goal is to create a robust framework that allows your business to thrive, regardless of the challenges that may come your way.

Why Business Funding Is Crucial for Scaling

Securing small business funding is essential for scaling your business effectively. It serves as the fuel that powers your growth initiatives, whether that means investing in new technology, hiring additional staff, or expanding your marketing efforts. Without adequate funding, even the best business concepts can struggle to gain traction. Having access to the right financial resources enables companies to take calculated risks, seize new opportunities, and drive sustainable business growth.

Types of Business Funding for Scaling

There are a variety of funding options available to support your scaling efforts. Business loans are a popular choice, allowing you to secure a lump sum that can be used for various purposes, from purchasing equipment to increasing inventory. If you’re open to giving away a slice of your business, equity financing is an option where you attract investors in exchange for ownership shares. For start-ups with high growth potential, venture capital can be a game changer, providing both funding and valuable advice. Crowdfunding has also gained popularity, letting you raise small amounts of money from a large audience. Additionally, exploring grants and competitions can yield funding opportunities that don’t require repayment, making them a great option for qualifying businesses.

How to Choose the Right Funding Option

Selecting the right funding option requires careful consideration of several factors. Assess the amount of funding you need, repayment terms, your business model, and where you are in your growth journey. Each funding source has its advantages and disadvantages, so it’s important to understand them to make informed decisions that align with your specific goals. This approach ensures that the funding you secure will effectively support your scaling efforts.

Key Growth Areas Supported by Business Funding

With the right business funding, you can focus on crucial growth areas. Product development becomes more feasible, allowing you to enhance existing offerings or create new ones. Marketing efforts can expand, reaching new customers and driving sales. Hiring talent is another significant area that benefits from funding, as bringing in skilled professionals helps propel your business forward. Finally, investing in infrastructure ensures that your operations can scale smoothly and efficiently.

Challenges of Scaling Without Proper Funding

Scaling without sufficient funding presents a host of challenges. Cash flow issues may arise, and you could miss out on valuable growth opportunities. Companies might find themselves struggling to maintain quality while trying to meet customer demands or keep up with the competition. Without proper financial support, the risk of stagnation increases, which can seriously hinder your business’s potential for success.

Business funding is an integral part of scaling your company. By understanding the different types of funding available and knowing how to choose the right option, businesses can set themselves up for growth and success. With the right business expansion strategies in place, you can unlock exciting opportunities and transform your business potential into reality.

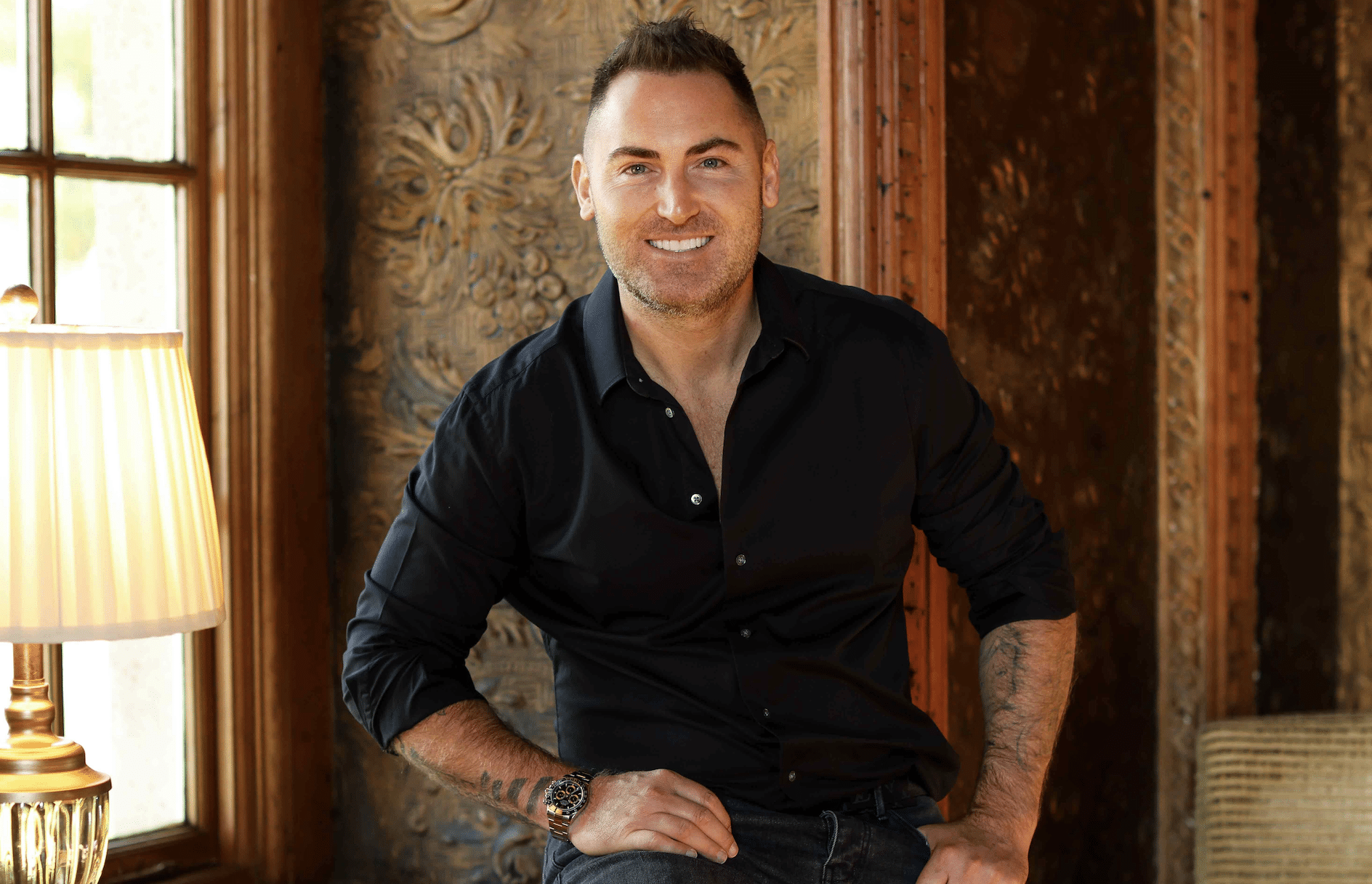

Contact Matt Haycox for expert advice and tailored funding solutions that meet your unique business finance needs.