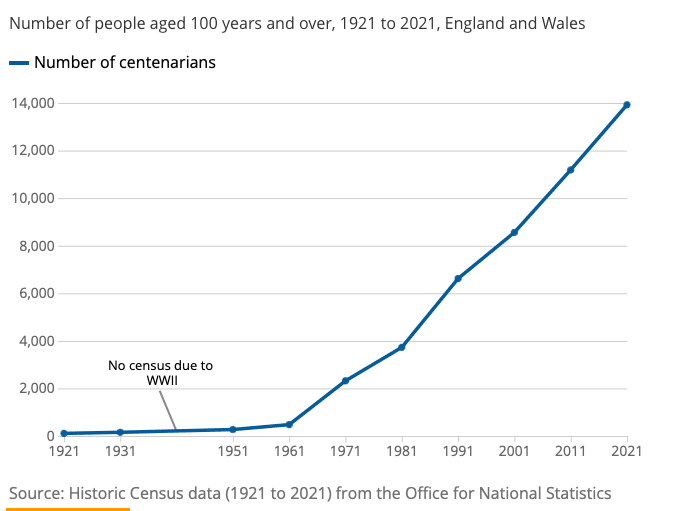

New data from the Office for National Statistics (ONS) has revealed that more people are now living to 100 and beyond than ever before, as life expectancy improves.

In a new study just released, the ONS said on Census Day in 2021 there were 13,924 centenarians living in England and Wales, a 24.5% increase from 2011. This is the highest number of centenarians recorded in an England and Wales census, and compares to just 110 centenarians in 1921.

The ONS revealed that the number of people living to age 100 has increased over time as life expectancy improves, boosted by advances in healthcare and public health measures, which led to improved air quality and working conditions. And a quarter of centenarians report having “good” or “very good” health.

There were 11,288 female and 2,636 male centenarians living in England and Wales in 2021. However, centenarians still only represent 0.2% of the total population.

The ONS said Census 2021 centenarians have lived considerably longer than would have been expected at the time of their birth. A boy born in 1921 would have been expected to live for around 61 years, and a girl around 68 years.

The ages of centenarians living in England and Wales ranged from 100 to 112, but over 90% were aged between 100 and 103 years.

Around the time of their birth in 1921, life expectancy was 67.9 years for females and 61.2 years for males, according to our Life tables, principal projection, England and Wales dataset. This cohort have outlived their life expectancy by an average of 32 years for females and 39 years for males.

WHAT IS THE LIFE EXPECTANCY FOR BABIES BORN IN 2021?

In contrast, for babies born in 2021, their life expectancy at birth is projected to be 90.5 years for females and 87.6 years for males. For these babies, 19.6% of females and 14.1% of males can expect to live to become a centenarian.

The majority (95.8%) of centenarians living in England and Wales identified in the “White” ethnic group, 2.1% identified in the “Asian, Asian British, Asian Welsh” ethnic group, and 1.1% in the “Black, Black British, Black Welsh, Caribbean, or African” ethnic group.

Most of the Census 2021 centenarians (91.8%) were born in the UK, compared with 83.2% of the population as a whole.

THE FINANCIAL IMPACT OF LIVING LONGER

As life expectancy increases and we all live longer, governments around the world are grappling with how best to deal with ageing populations.

Just this week, it was revealed that more than 1 in 10 people in Japan are aged 80 or older for the first time as the country’s population has been shrinking and growing older for decades with young people delaying marriage and kids due to job instability and economic worries. Read more on this story>

The UK Treasury is understood to be discussing a possible one-off break from its pensions triple lock, the policy which ensures the basic state pension received in retirement rises each year, in line with whichever is the highest out of three factors: wage growth, inflation or 2.5 per cent. A one-off break could save it as much as £1bn.

Earnings volatility during the pandemic and recent high inflation have put pressure on the government to make difficult decisions, with questions hanging in the balance over the future of the triple lock.

On its current trajectory, the UK state pension is set for larger-than-expected increases, as annual wage growth remains the highest since records began in 2001, according to the ONS, and the deal of the triple lock means it has to increase in line with whichever is the highest of the three factors (wage growth, inflation or 2.5%).

Meanwhile, the number of families contributing to their under-18 year old children’s pension pots has soared from 25,000 in 2018 to 38,000 in 2021, according to research.

Data from Lubbock Fine Wealth Management showed that families poured £67.5m into the pension pots last year alone.

Görkem Gökyiğit, chartered financial planner at Lubbock Fine Wealth Management, said more families were taking advantage of attractive tax reliefs to start building wealth for their children.

Keep up-to-date with the latest business news and analysis over on Matt Haycox Daily. For all the latest news, insights and strategy, sign-up to the Matt Haycox weekly newsletter, below.