In today’s fast-changing business world, digital transformation has become a necessity rather than a choice. Companies across the UK are increasingly adopting digital tools and strategies to stay ahead, improve customer experiences, and streamline their operations. However, the cost of digital transformation can be high, and many businesses find it challenging to cover these expenses out of pocket. This is where secured business loans can make a real difference. In this blog, we’ll look at how you can use secured business loans to fund your digital transformation efforts and set your business up for long-term success.

What Digital Transformation Really Means

Digital transformation is about more than just adopting new technologies. It’s about integrating digital tools into every aspect of your business, changing how you operate, and delivering better value to your customers. This might involve automating processes, using data analytics to make better decisions, improving customer engagement, or boosting your digital marketing efforts.

How Secured Business Loans Can Help

Secured business loans are a type of financing where you put up collateral, such as property, equipment, or other valuable assets, in exchange for the loan. Because these loans are less risky for lenders, they usually come with lower interest rates, larger amounts, and more flexible repayment terms than unsecured loans. This makes them an ideal option for funding substantial digital transformation projects.

Smart Ways to Use Secured Business Loans for Digital Transformation

1. Investing in New Technology

The right technology is the foundation of any digital transformation. Whether you need to upgrade your hardware, buy new software, or move your operations to the cloud, a secured business loan can provide the necessary funds. Upgrading your technology can increase efficiency, lower costs, and give you a competitive advantage.

2. Enhancing IT Infrastructure

Your IT infrastructure is the backbone of your digital operations. With a secured business loan, you can make important upgrades like improving cybersecurity, boosting server speed, and enhancing network reliability. These improvements are vital for protecting your business from cyber threats and ensuring smooth digital operations.

3. Improving Customer Experience

In today’s digital age, customer experience is more important than ever. A secured loan can help you invest in customer relationship management (CRM) systems, AI-driven customer service tools, and mobile apps that provide personalised interactions. These technologies can help you build stronger relationships with your customers and increase their loyalty.

4. Leveraging Data Analytics

Data is one of the most valuable resources a business can have. Getting a secured business loan can help you acquire data analytics tools and hire experts to turn your data into actionable insights. By using advanced analytics, you can make better decisions, optimise your operations, and improve customer satisfaction.

5. Expanding Digital Marketing

Effective marketing is crucial for business success in the digital age. A secured business loan can give you the funds needed to expand your digital marketing efforts, whether that means increasing your social media presence, investing in content creation, or improving your website’s SEO. By boosting your online visibility, you can reach a wider audience and generate more leads.

Digital transformation is key to staying competitive and relevant in today’s business environment. Secured business loans offer a practical way to finance these efforts, allowing you to invest in the technologies and strategies that will drive your business forward. By understanding the advantages of secured loans and using them wisely, you can ensure your business thrives in the digital age.

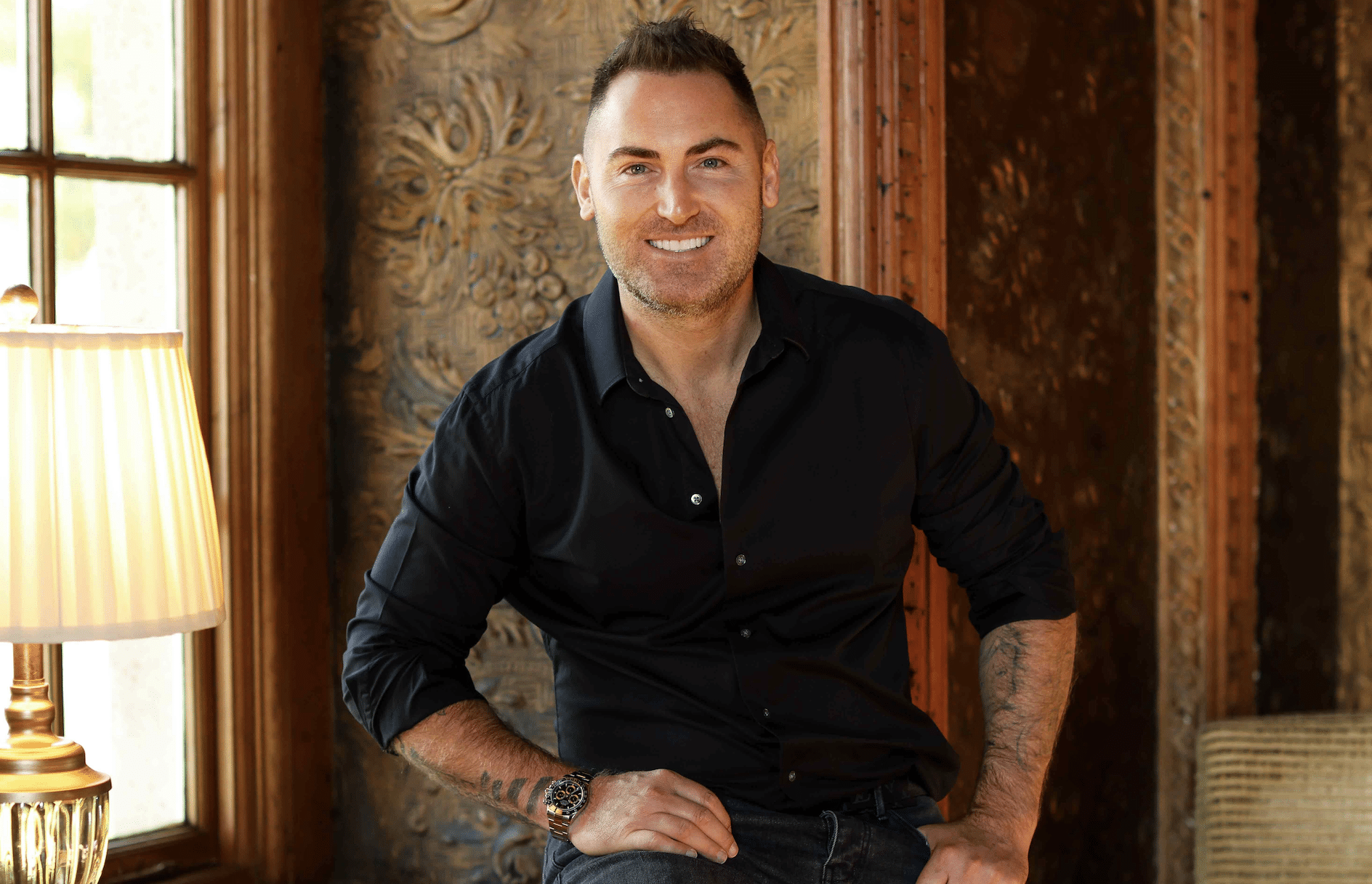

Let Matt Haycox help you secure the funding you need to make it happen. Contact us today to explore your options and get expert advice tailored to your business goals!