ECONOMY

The Bank of England (BoE) is expected to raise interest rates to 5.5%, following a meeting planned for this Thursday. This increase would take the cost of borrowing to its highest level since early 2008, but markets and economists anticipate this latest 0.25% hike would be the last in the cycle. The rise would follow a similar move from the European Central Bank last week. But a big unknown for economists both inside and outside of the BoE is the August inflation data which will be published on Wednesday, a day before the rate decision is announced.

RETAIL

High street billionaire Mike Ashley is reportedly in talks to sell online fashion retailer Missguided to Chinese ultra-fast-fashion giant Shein. Ashley’s Frasers Group swooped in to buy Missguided out of insolvency 18 months ago and if Shein (which has a $66bn (£53bn) valuation) snaps it up, it will be its first acquisition of a British fashion brand. The two sides are understood to be “in detailed negotiations” about a deal.

Fierce competition and extreme weather across Europe hit sales at fashion group H&M, with the mid-market clothing retailer declaring “flattish year-on-year sales” in the three-months to the end of August, disappointing the market which had expected 5% growth. This interim management statement comes before a nine-month report due to be released on 27 September and contrasts sharply with rivals, such as Zara-owned Inditex, who posted stellar sales and profits in its latest results.

Retailers are losing $100 billion a year from return fraud, bots and coupon stacking, a new study from anti-fraud company Riskified revealed. For the study, it surveyed over 300 global companies with more than $500 million in total annual revenue. The firm found retail policy abuses, such as return fraud and using fake email addresses for promo codes, is rising for some retailers. The practices tend to spike during the holidays or during times of high inflation.

FINANCE

The number of UK companies pushed into insolvency jumped by a fifth last month as rising interest rates and higher bills continued to take their toll. Just over 2,300 businesses were registered insolvent in August, according to the latest government statistics: a 19 per cent year-on-year increase and above the pre-pandemic number.

TECH

A landmark trial between the US government and tech giant Google is now underway, as the government attempts to rein in the stranglehold tech giants have over the industry. Google is being accused of unfairly cementing its position as the world’s go-to search engine by paying billions of dollars to phone-makers like Apple and web browsers like Mozilla to be installed as the default option. Google handles some 90% of global search queries. The CEO of Google’s parent company, Alphabet, is expected to testify over the 10-week trial, as are executives from Apple.

AI

The rise of surge pricing: “It will be everywhere,” reported the FT in its Big Read feature. Powered by algorithms and AI, a growing number of consumer industries are adjusting prices in response to supply and demand. Dynamic pricing, whereby businesses flex prices at particular times in response to supply and demand, is not a new concept but now powered by algorithms and AI, it is being introduced at a rapid pace by a growing number of consumer industries, as high inflation erodes margins and improvements in tech make the model easier to implement.

LUXURY

Gucci, Cartier and Louis Vuitton are understood to be among the luxury brands to sign leases for stores in Indian tycoon Mukesh Ambani’s new Mumbai mall, as luxury firms and Reliance Industries seek to profit from strong economic growth and a rapid rise in the number of millionaires. The Jio World Plaza, which an industry source said is likely to open this year, is located inside Reliance’s $1 billion business and cultural hub in Mumbai’s business district.

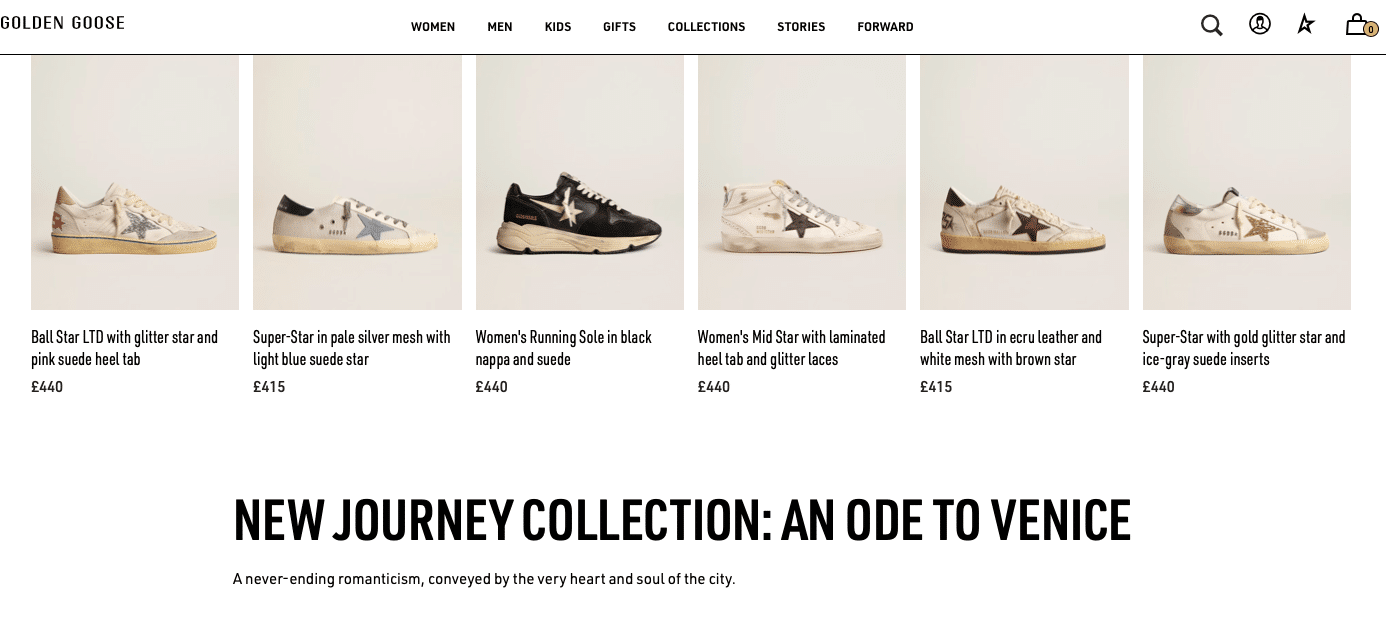

Luxury Italian sneakers brand Golden Goose posted net revenue of €276.4 million in the first half of 2023, equivalent to a 21% hike on the previous year, and a 65% improvement on the same period in 2021. EBITDA was also up, rising 34.6%. Its CEO Silvio Campara put their success down to new store openings, the growth of D2C and “the power of brand and community.” Golden Goose posted double-digit growth in all its main markets: the Americas region grew by 12%, Europe by 24%, and Asia-Pacific by 19%.

SPORTS

Ferrari has renewed its partnership with German sports goods maker, Puma. The Italian sports car maker said under the renewed multi-year partnership, Puma will continue to be the licensing partner for Ferrari-branded products and the supplier of F1 team and racewear for Ferrari. The renewal of the partnership reinforces strong ties between the two companies, which started in 2005 when Puma agreed to provide Ferrari’s F1 team with sportswear, shoes and accessories.

MARKETS

The owner of Waterstones, investment firm Elliott Advisors, is understood to be among a pack of bidders eyeing up The Body Shop, after its Brazilian owners Natura put it up for sale. Natura has owned the high street chain since 2017. According to City sources, the auction, which is being handled by bankers at Morgan Stanley, is “proceeding at pace”.

ESG INVESTING

Trillion-dollar green finance targets set by leading investment banks are driving the boom in “sustainable” debt deals, many of which have attracted criticism for funding high-emitting companies or financing projects unrelated to environmental goals. But banks are still working on how to calculate the greenhouse gas emissions linked to their activity financing clients in polluting industries, and they may be forced to start disclosing these emissions in California from 2027 and earlier in the UK, which would increase pressure to cut ties with polluters.

Keep up-to-date with the latest business news and analysis over on Matt Haycox Daily. For all the latest news, insights and strategy, sign-up to the Matt Haycox weekly newsletter, below.