Securing the right funding for your business isn’t just about money, it’s about unlocking potential. Whether you’re launching a new business or scaling an existing one, having access to the right financial resources can mean the difference between surviving and thriving. But with so many options available, where do you even start?

In 2025, the funding landscape has evolved significantly. From traditional bank loans to innovative fintech solutions, businesses now have more choices than ever. However, with more options comes the challenge of choosing the right one.

This guide will walk you through everything you need to know about quick business funding, helping you secure the right support for your goals.

Understanding Business Funding Needs

Before jumping into funding options, it’s crucial to understand your business’s unique financial needs.

How to Determine the Capital Required

The first step in securing business funding is knowing exactly how much you need. Ask yourself:

- What are my immediate costs (e.g., equipment, inventory, marketing)?

- What recurring expenses will I face in the next 6-12 months?

- What is my expected revenue, and how long until I become profitable?

Breaking down your finances helps you avoid borrowing too much—or too little. Remember, taking on excess debt can become a burden, while insufficient funds can halt growth before it starts.

Short-Term vs. Long-Term Funding Needs

Understanding the difference between short-term and long-term funding needs is critical. Short-term business funding is ideal for:

- Covering temporary cash flow gaps

- Purchasing urgent inventory

- Managing unexpected expenses

On the other hand, long-term business funding supports:

- Expansion into new markets

- Investing in new equipment

- Hiring additional staff

Knowing your timeline will help you choose the right funding source for your needs.

Types of Business Funding

Every business is unique, and so are its funding options. Let’s explore the different types available in 2025.

Equity-Based Funding

Equity funding involves giving up a share of your business in exchange for capital. While it might seem daunting to give away ownership, it can provide significant benefits such as mentorship and strategic partnerships.

- Angel Investors: Individuals who provide capital in exchange for equity, often bringing valuable experience and industry connections.

- Venture Capital: Firms that invest in high-growth businesses, expecting a return when the company scales.

- Crowdfunding: Raising small amounts from a large number of people, usually through online platforms.

Debt-Based Funding

If maintaining full ownership is a priority, debt financing might be the way to go.

- Bank Loans: Traditional but reliable, banks offer structured repayment plans with competitive interest rates.

- Business Lines of Credit: Flexible access to funds when you need them, without committing to a lump sum loan.

- Microloans: Smaller loans designed for startups or businesses that might struggle to secure traditional financing.

Alternative Funding Options

Sometimes thinking outside the box can provide the perfect funding solution.

- Revenue-Based Financing: Repay funds based on a percentage of your monthly revenue.

- Invoice Factoring: Sell unpaid invoices to improve cash flow instantly.

- Peer-to-Peer Lending: Borrow directly from individuals via online platforms, often with fewer restrictions than banks.

Grants and Subsidies

Finding free money for your business sounds like a dream, doesn’t it? But grants and subsidies can make that dream a reality, if you know where to look and how to apply. Whether it’s government initiatives to support small businesses or private sector funding aimed at specific industries like tech, healthcare, or sustainability, grants offer a powerful way to grow without accumulating debt.

Imagine a sustainable fashion startup that secured a government grant aimed at reducing carbon emissions in manufacturing. With the funding, they were able to develop eco-friendly production processes, scale their operations, and capture new markets. The key takeaway? Grants not only provide capital but also open doors to credibility and networking opportunities.

Types of Grants Available

- Government Grants: Designed to support economic growth, innovation, and job creation.

- Private Sector Grants: Provided by corporations or foundations focusing on niche areas.

- Sustainability Grants: Specifically targeting businesses working toward environmental goals.

Emerging Trends in Business Funding

The funding landscape is evolving at lightning speed. Entrepreneurs today have more options than ever, but understanding the trends can be the difference between success and missed opportunities.

Growth of ESG-Aligned Investments

Investors are increasingly looking for businesses that align with Environmental, Social, and Governance (ESG) values. Companies that prioritise sustainability, ethical business practices, and social impact are securing more funding than those that don’t. If your business contributes to a greener future, you’re in a strong position to attract investment.

Popularity of Crowdfunding Platforms

Crowdfunding has leveled the playing field, allowing startups and small businesses to pitch their ideas to the world. Platforms like Kickstarter and GoFundMe offer exposure and funding simultaneously, but success hinges on storytelling. If your pitch connects emotionally, you’re more likely to secure support.

Rise of Fintech Lenders and AI-Driven Funding Decisions

Fintech is revolutionising how businesses access capital. With AI-driven algorithms assessing risk, lending decisions are faster and more accurate. No more waiting months—now you can secure funding within days, sometimes hours.

Eligibility and Preparation

Securing business funding isn’t just about having a great idea—it’s about proving to lenders or investors that your business is worth the risk. Preparation is key, and it starts with getting your financial house in order and presenting your business in the best possible light.

How to Prepare a Compelling Business Plan

Your business plan is your story – it’s what makes investors and lenders believe in your vision. Think of it as your business’s resume; it should showcase your goals, strategies, and how you’ll achieve them. Here’s what your business plan must include:

- Executive Summary: A clear and compelling overview of your business and why it’s a great investment opportunity.

- Market Analysis: Show that you understand your industry, target audience, and competitors.

- Financial Projections: Include detailed cash flow forecasts, profit and loss statements, and growth projections.

- Operational Plan: Outline how your business operates on a daily basis.

- Unique Value Proposition (UVP): What makes your business stand out from the competition?

A well-prepared business plan doesn’t just impress funders—it also provides you with a roadmap to success.

Credit Score Requirements and Improving Financial Profiles

Your credit score is like your business’s financial report card. Lenders use it to gauge how reliable you are in repaying debt. A strong credit score can open doors to better funding options, while a weak one can lead to rejections or high-interest rates.

If your credit score isn’t where it should be, here are some steps to improve it:

- Pay bills on time: Even one late payment can impact your score.

- Reduce debt-to-income ratio: Keep your business debt levels manageable.

- Check your credit report: Dispute any errors that may be dragging down your score.

- Build positive credit history: Regularly use and repay credit to build trust with lenders.

Improving your financial profile takes time, but it’s worth the effort for better funding opportunities.

Common Documents Needed

When applying for funding, be prepared to provide:

- Financial Statements: Profit and loss statements, balance sheets, and cash flow statements.

- Tax Returns: Typically for the past 2-3 years to verify income and financial stability.

- Business Licenses: Proof that your business is legally compliant.

- Projections: Forecasts demonstrating how the funding will drive growth.

- Personal Financial Information: If you’re a small business owner, lenders may want to see your personal financial health.

Having these documents ready speeds up the funding process and shows funders you’re serious.

Application Strategies

Applying for business funding can be daunting, but a strategic approach increases your chances of success. Knowing where to apply, how to present yourself, and what to expect can make all the difference.

How to Identify the Right Funding Source for Your Business Type

Every business is unique, and so are funding sources. Ask yourself:

- Do I need short-term cash flow assistance or long-term investment?

- Am I willing to give up equity in exchange for funding?

- How quickly do I need the funds?

If you’re a startup, equity funding like angel investors or venture capital might be a good fit. For established businesses, traditional bank loans or alternative lenders may offer better terms.

Tips for Approaching Lenders, Investors, or Grant Providers

First impressions matter. Approach potential funders with confidence by:

- Researching beforehand: Understand what each funder is looking for.

- Being transparent: Clearly explain how much funding you need and how you’ll use it.

- Practicing your pitch: Be ready to communicate your business value succinctly.

- Building relationships: Networking can often lead to funding opportunities.

Crafting a Strong Pitch Deck

A great pitch deck is your golden ticket to capturing an investor’s attention. Focus on these key elements:

- Problem and Solution: Clearly define the market problem and how your business solves it.

- Market Opportunity: Show evidence of demand and growth potential.

- Business Model: Explain how your company makes money.

- Financials: Be honest about your numbers and projections.

- Call to Action: End with a clear ask—whether it’s funding, mentorship, or a partnership.

Common Challenges and Solutions

Even with the best preparation, funding challenges can arise. Whether it’s rejection, cash flow issues, or debt management, having a plan to overcome these hurdles is crucial.

Overcoming Business Funding Rejections: Alternatives and Next Steps

Rejection is not the end of the road. Here’s how to bounce back:

- Ask for feedback: Learn why your application was denied and work on those areas.

- Consider alternative funding: Peer-to-peer lending, invoice factoring, or even bootstrapping.

- Strengthen your application: Improve financials, credit scores, or business plans before reapplying.

Many successful entrepreneurs faced multiple rejections before landing the right funding.

Managing Funding Gaps During Scaling Phases

Scaling a business often leads to temporary cash flow shortfalls. To manage these gaps:

- Plan ahead: Forecast your cash flow needs in advance.

- Diversify income streams: Don’t rely on one source of revenue.

- Use revolving credit: Business lines of credit can act as a safety net.

Having a solid financial cushion can prevent operational disruptions.

Strategies for Reducing Debt Burdens

Debt can quickly become overwhelming if not managed properly. To keep it under control:

- Negotiate terms: Lenders may offer better repayment schedules if you ask.

- Prioritise high-interest debt: Pay off the most expensive debts first.

- Monitor spending: Stick to a budget and avoid unnecessary expenses.

Remember, borrowing should be strategic – not just a quick fix to financial struggles.

Case Studies and Real Life Examples of Business Funding

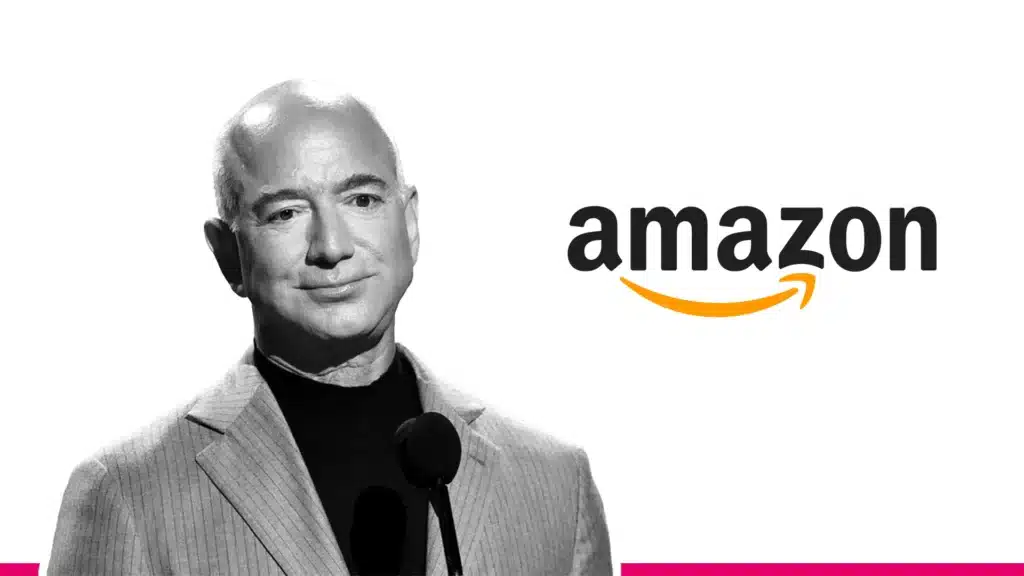

- Jeff Bezos – Amazon’s Early Funding Struggles and Triumph

When Jeff Bezos founded Amazon in 1994, it was nothing more than an online bookstore operating out of his garage. But Bezos had a grand vision—he wanted to build the world’s largest online retailer. To turn his dream into reality, he sought funding from family and friends, managing to raise about $1 million in early seed capital.

However, Amazon faced major hurdles when it came to convincing traditional investors. Many thought the idea of an online-only bookstore was risky and unsustainable. Bezos, however, persevered with a clear, data-driven business plan that highlighted the potential of e-commerce. By 1995, Amazon secured $8 million in Series A funding from Kleiner Perkins, a top venture capital firm.

Lesson: Persistence, a solid business plan, and a forward-thinking approach helped Bezos overcome skepticism and secure the necessary funding to grow Amazon into the global giant it is today. Entrepreneurs should be prepared to pitch their vision clearly and not be afraid to seek support from their personal network initially.

- Elon Musk – Tesla’s Financial Lifeline

Tesla, now a leading name in electric vehicles, faced severe funding crises in its early days. In 2008, Tesla was on the verge of bankruptcy, struggling with production costs and a lack of faith from investors. Elon Musk, who had already invested much of his own money from his PayPal earnings, had to take an all-or-nothing approach. He personally funded Tesla with $40 million to keep the company afloat while negotiating additional funding from investors.

Eventually, Tesla secured a crucial $465 million loan from the U.S. Department of Energy, which helped the company stabilise and move toward profitability. Musk’s relentless belief in Tesla’s potential and his willingness to take financial risks helped save the company from collapse.

Lesson: Sometimes, securing business funding requires personal sacrifices and the courage to take calculated risks. Government grants and loans can also be a valuable resource, especially for businesses focused on innovation.

- Oprah Winfrey – Building a Media Empire with Strategic Partnerships

Oprah Winfrey didn’t start with unlimited resources. She strategically partnered with major networks and sponsors to build her media empire, Harpo Productions. Initially, Oprah reinvested much of her earnings from “The Oprah Winfrey Show” back into her business, securing small but meaningful partnerships that provided financial stability.

When launching her OWN network, Oprah faced numerous financial challenges, including low ratings and high production costs. However, she secured funding through strategic partnerships with Discovery Communications, which invested $189 million, providing a crucial financial boost that helped the network succeed.

Lesson: Building relationships with the right strategic partners and investors can open doors to significant funding opportunities, even when challenges arise.

- Howard Schultz – Starbucks and the Challenge of Scaling Up

When Howard Schultz first pitched his idea to expand Starbucks from a small coffee shop into a global brand, he was met with repeated rejections. Many investors believed the concept was too niche and wouldn’t appeal to a broad market. Schultz kept pitching, eventually securing $3.8 million from investors, allowing him to buy Starbucks and start the journey of scaling the business globally.

Today, Starbucks is a household name, with a market cap of over $100 billion. Schultz’s story is a testament to resilience and understanding your market potential.

Lesson: Entrepreneurs should not give up after initial funding rejections. Keep refining your pitch and demonstrating the value your business brings to investors.

- Failed Case Study: Juicero – The $120 Million Mistake

Juicero, a startup that raised $120 million in venture capital, promised to revolutionise the juice industry with high-tech cold-pressed juice machines. However, the company’s downfall came when it was revealed that the expensive machines were unnecessary, customers could simply squeeze the juice packets by hand. Investors quickly pulled out, and the company shut down in 2017.

Lesson: Overpromising and underdelivering can be disastrous. Investors look for scalable, practical solutions, businesses must ensure their product genuinely solves a problem before seeking large funding rounds.

Maintaining Financial Health Post-Funding

Best Practices for Cash Flow Management

Getting the funds is exciting, but managing them wisely is what keeps your business afloat. Successful entrepreneurs monitor their cash flow religiously. It’s about knowing where every pound is going and ensuring there’s enough to cover expenses while planning for growth.

A practical tip? Create a cash flow forecast and stick to it. Anticipate slow months and prepare accordingly. Remember, healthy cash flow equals a healthy business.

Regular Reporting and Communication with Investors or Lenders

Investors and lenders don’t just give you money and disappear—they want updates. Regular reporting builds trust and reassures them that their investment is in good hands. Whether it’s monthly reports or quarterly meetings, keep them informed about your business progress, challenges, and future plans.

Planning for Future Business Funding Rounds

Securing funding once doesn’t mean the journey is over. Growth often demands additional capital. The best way to prepare for future funding is to consistently show strong financial performance and have a clear growth strategy.

Let Matt Haycox help you secure the business funding you need to make it happen. Contact us today to explore your options and get expert advice tailored to your business goals!

FAQs

When can I get an emergency business loan?

If you’re facing an urgent financial need, some lenders offer same-day or next-day funding, provided you meet their requirements and have the necessary documentation ready.

What documents do I need for emergency business finance?

Typically, lenders will ask for financial statements, tax returns, business plans, and cash flow projections. Having these ready can speed up the process.

How much can I borrow with a quick business loan?

The amount varies based on your business revenue, creditworthiness, and the lender’s policies. Some lenders offer up to £500,000, while others might cap it at lower amounts.

What factors affect the loan application approval?

Your credit score, business revenue, existing debt, and the strength of your business plan all play a role in the lender’s decision.

What are the interest rates, and how are they determined?

Interest rates depend on the type of loan, your credit profile, and the lender’s risk assessment. Typically, rates can range from 5% to 30% depending on the urgency and loan type.