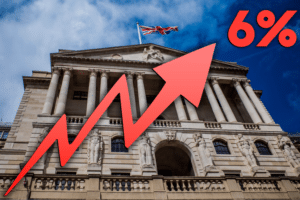

Here is a bit of news that could have hard pressed entrepreneurs weeping in the summer rain – the cost of borrowing is going up yet again.

The Bank of England is likely to put up interest rates again , on August 3, from

5% to between 5.25% and 5.50%, with a peak of 5.75% expected later in the year.

This would be the 14th interest rise in-a-row, a world away from the cold winter post-Covid days of December 2021, when the interest rate was 0.1 %

6% next year ?

Economists polled by Reuters say interest rates may not peak at yet 6% next year, as predicted last month. There are strong signs that inflation – the reason behind all of the rises – is slowing.

The latest figures show a slowing of inflation to 7.9% in June – still the highest inflation rate of any of the G7 countries. Petrol and diesel prices – down 23% on a year ago – have been the biggest help in bringing UK inflation down.

Interest rates on pause ?

Increasing wage demands, due to a shortage of labour, the war in Ukraine and the rise in the cost of living have led to soaring prices.

Yet now, with inflation easing, the Bank of England could be under pressure to put the interest rate on pause. There is fear that the increasing tightening of monetary policy could induce a slump in the UK economy. Word is that this is the current advice to Chancellor Jeremy Hunt.

All indicators looking better.

Martin Beck, the chief economic advisor to the EY Item Club, believes that more interest rates will be difficult to justify, given slowing inflation.

“The Bank is too focused on the past. All forward indicators are looking better,” he says.

Sterling weakens, opposition strengthens.

Sterling has weakened and investors scaled back their bets on future increases in borrowing costs.

On the political front,Opposition Labour politicians have accused the government of risking a mortgage crisis by ramping up the cost of borrowing.